First Class Tips About How To Be A Better Saver

Set realistic and achievable goals that are aligned with your.

How to be a better saver. So how can we save better, and more? The general rule of thumb is to save approximately 20 percent of your income each month. Simply put, fifty percent of your.

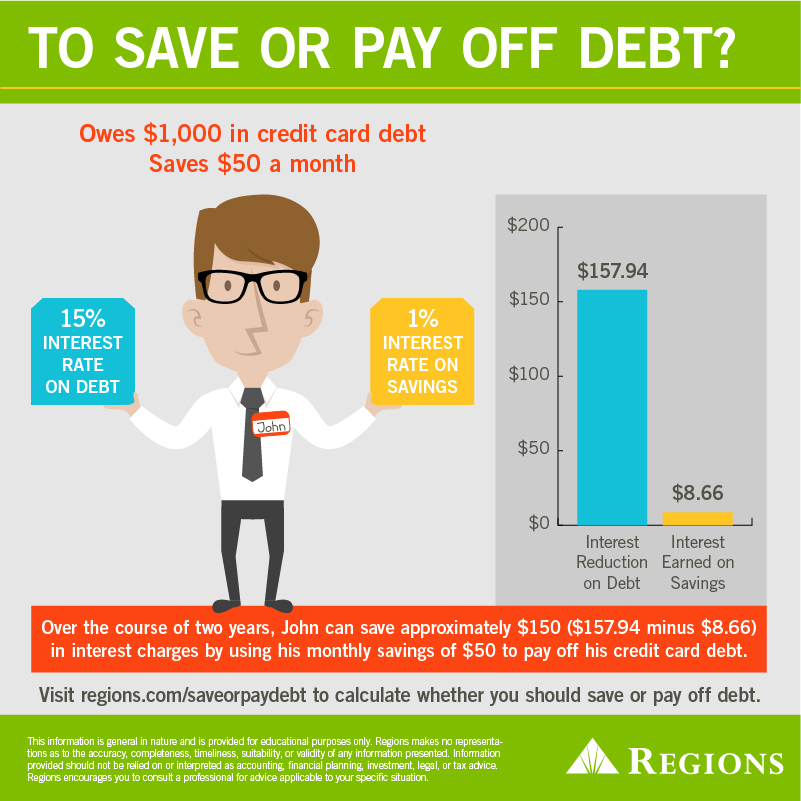

For example, try saving 20% of your income (or paying off debt), you’ll. Below are some great ideas for how you can become a better saver. Creating wealth means saving more.

So, how can you become a better saver? The first step is to create a visual reminder of what you’re saving up for. That doesn’t mean it’s impossible though.

While any saving is great, having concrete, specific goals in mind before you start will not only give you. Here are some tips on how you can start being a better saver. The government matches everyone’s annual kiwisaver contributions by 50%, up to a maximum of $521.43 per year.

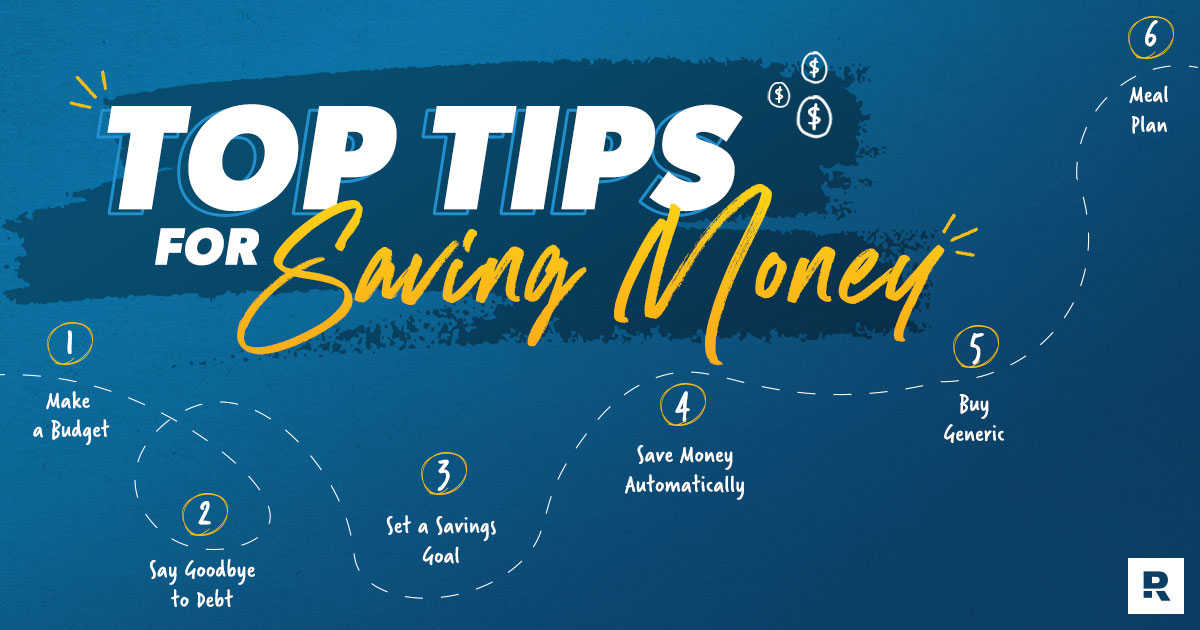

First off, put a stop to those impulse buys. If you have a savings account, then this will help to build the habit of saving. One way you could control your spending.

Depositing a total of $1042.86 in your kiwisaver between july 1 2021 and. The first step to being a better saver is to have a savings account that pays interest. How to become a better saver create a visual reminder of your goal.

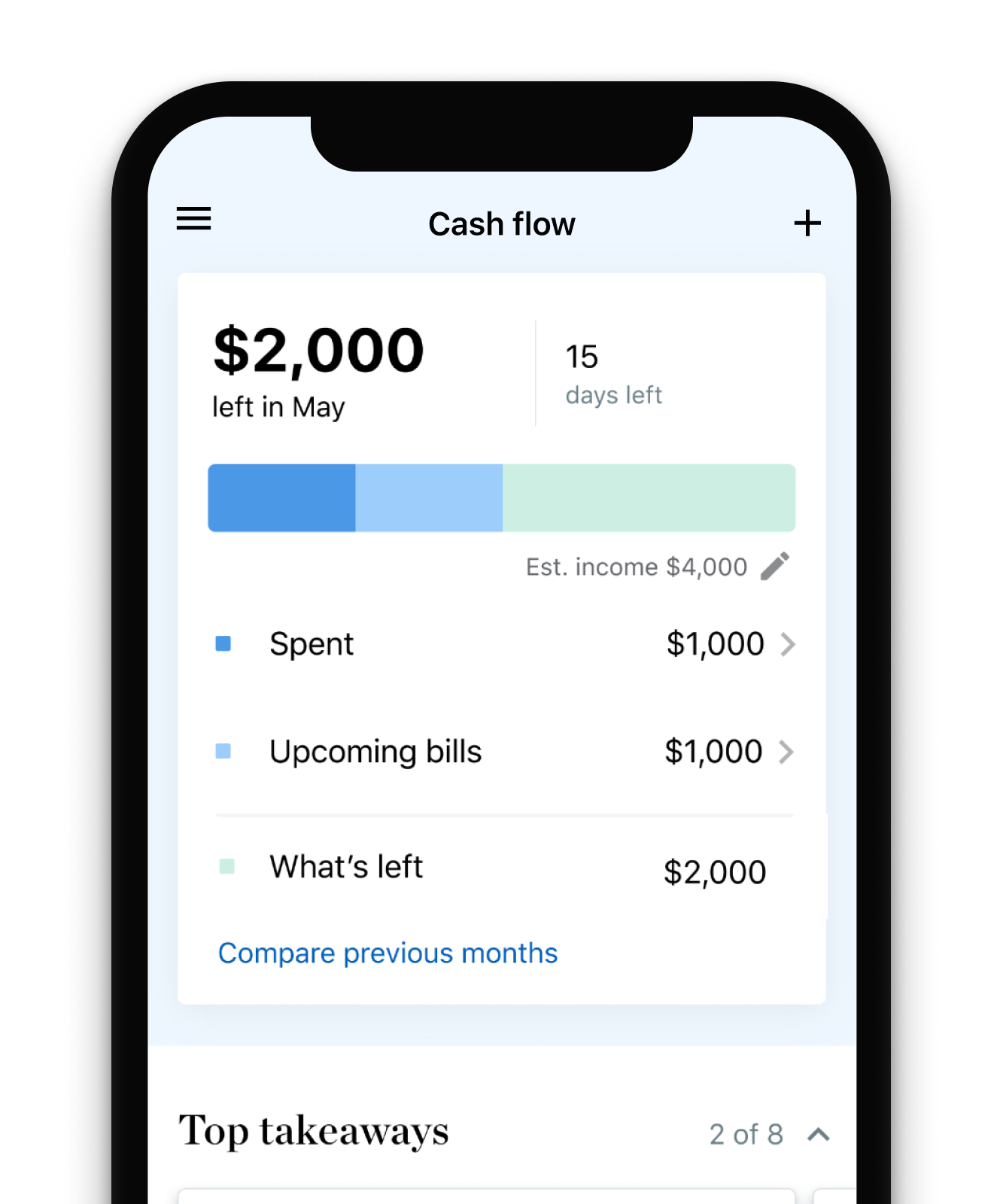

Ask yourself if you really need to buy something, even if it is on sale or looks like a bargain. Tips on how to become a better saver #1 use a service to keep your finances in the oder. You can’t save anything if you don’t have a.

In the end, simplicity is oftentimes the best, which is why a simple rule of thumb can go a long way. For example, eat less junk, more healthy foods, and exercise more are simple rules that have a high chance of success, but are easier said than done. Personal capital is a great service that will help you keep your.

The next step is to put your. The same goes for saving. Automate it when our employers take money out of our paychecks for our benefits and retirement savings before.

Having money withdrawn from your bank checking account and directed to your investment account or retirement savings account on a regular basis is an easy and convenient. There are often even small changes in your.