Unbelievable Tips About How To Buy Preferred Stock

Details about preferred stock risk.

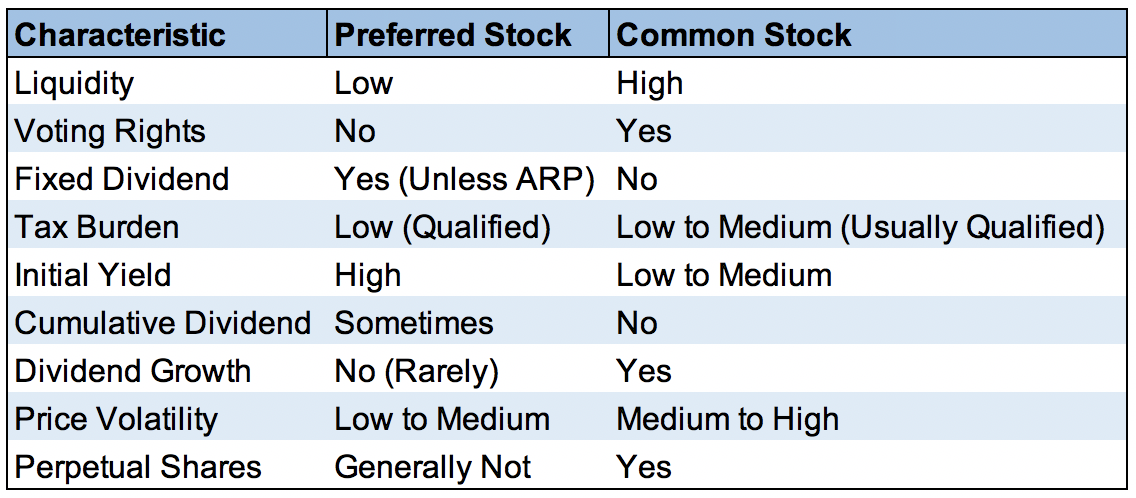

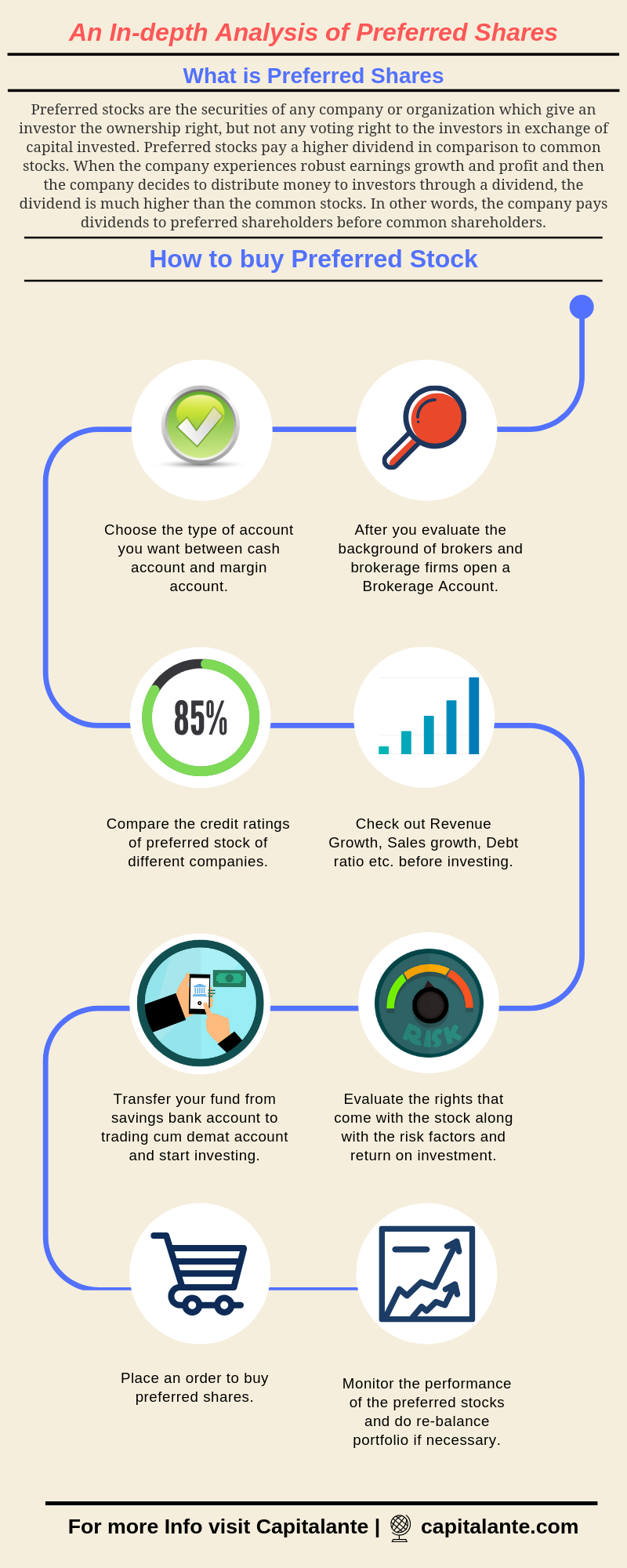

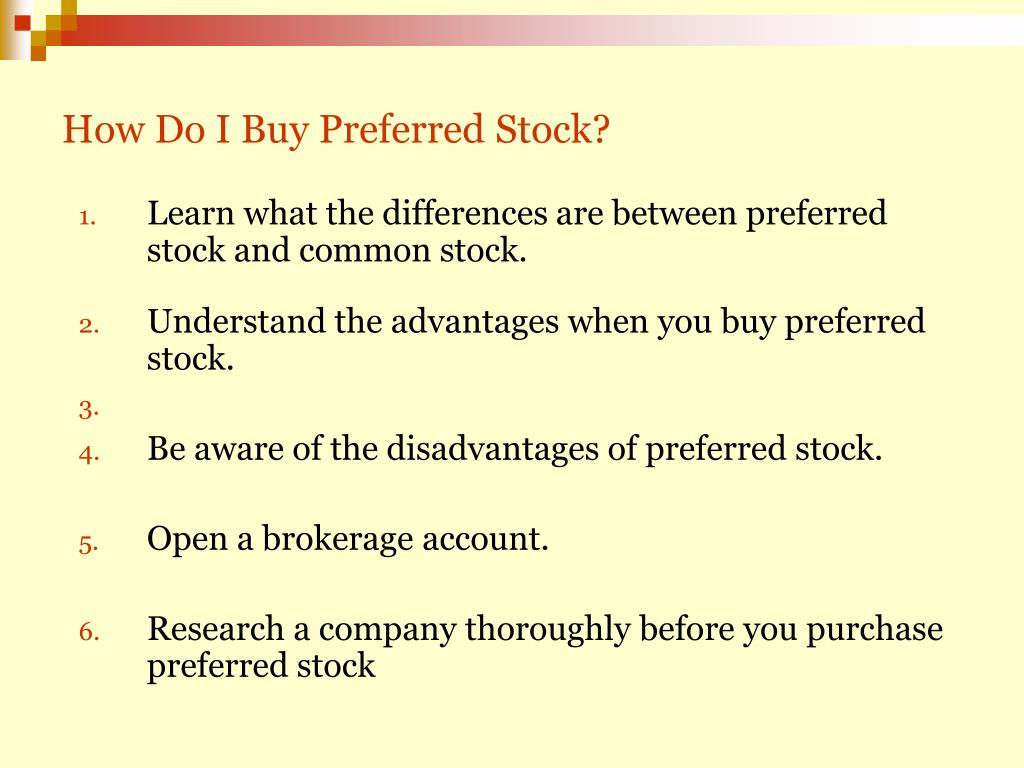

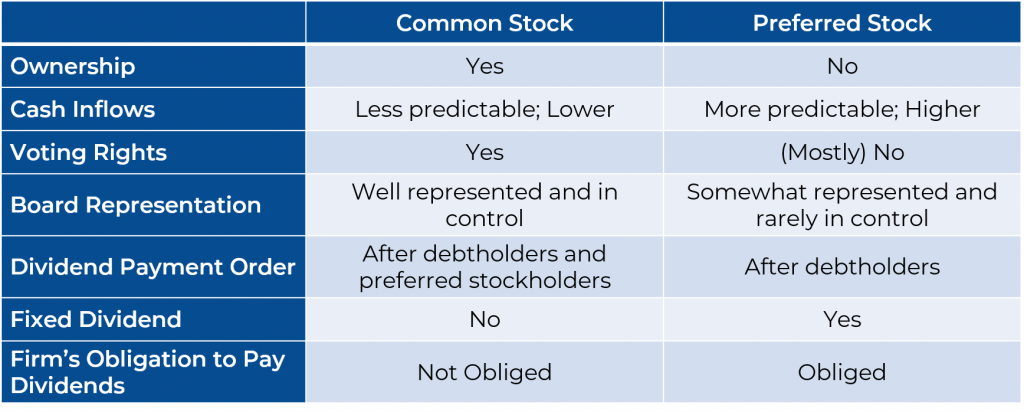

How to buy preferred stock. Interest rate the risk that the value of a fixed income. The differences between preferred stock and common stock are few but crucial. Check in on your investment.

Some companies issue preferred stocks to raise cash. The other way to buy preferred stock is by purchasing shares of a preferred stock mutual fund or etf. If we consider common stocks, they have the highest rate of return amongst other similar forms of investments.

It is one of the best. Before buying a preferred stock, always pay attention to the characteristics of the individual issue. Preferred shares are issued in a similar manner to common shares.

Mutual fund schemes with a focus on international. Moneycontrol according to a report by, people give more preference to mutual funds for investing in stocks listed abroad. Buy your desired number of shares with a market order or use a limit order to delay your purchase until the stock reaches a desired price.

They put you high on the ownership ladder. Some preferred shareholders also have the right to convert their preferred stock into common stock at a predetermined exchange price. Choosing your preferred stocks 1.

Is buying preferred stock a good investment?. To buy this type of stock, you will. How to buy things on amazon.

How to buy preferred stock although preferred stock can be bought on exchanges just like common stock, this isn’t the case most of the time. To find good stocks to invest in, think about companies you. Preferred shareholders indeed receive dividend payments:

Identify preferred stocks that capture your interest. Preferred stocks get preferential treatment over common. Preferred stock often has a callable feature that allows the.

This includes bonds and preferred stocks. Preferred stocks are beneficial to an investor. How to buy preferred stocks online.

The dividends are a selling feature,. Preferred shares are so called because they give their owners a priority claim whenever a company pays dividends or distributes assets to shareholders. Your dividend is fixed and.

/PreferredStock-FINAL-c6dbf29d50d34121aa17f0b7ea771bad.png)

/PreferredStock-FINAL-c6dbf29d50d34121aa17f0b7ea771bad.png)