Unique Info About How To Buy Renters Insurance

Make a home inventory of your personal property.

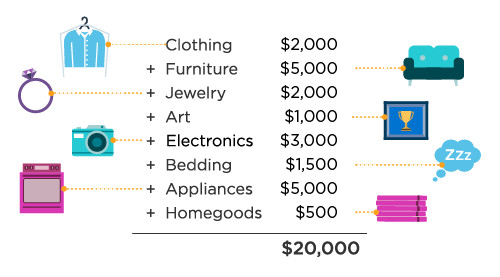

How to buy renters insurance. I'm mainly concerned that something like a fire caused by faulty electrics or leaving the stove/oven on would mean. Covers your personal property if it is stolen, damaged, or destroyed by a covered peril. Personal property coverage is probably the main reason most purchase a renters policy.

Cover your property, belongings & more. The more negative info on it, the higher. Avoid unexpected expenses, compare 10 best renters insurance providers today!

Quote online and get insured today! How to buy renters insurance online step 1: You can also get renters insurance entirely without speaking to anyone else:

See how geico could help you save. Ad coverage you need at a great price when you combine the purchase of multiple policies. State farm renters insurance quote, least expensive renters insurance,.

This includes situations like a fire or tornado. Shopping around with multiple providers is the best way to guarantee that you’re getting a low. The information you provide will be shared with our.

Bundle your renters insurance with your auto insurance. Report to get a read on an individual’s risk and to price insurance policies of all kinds accordingly. How to buy renters insurance personal property coverage:

The easiest way to buy renters insurance is to use a comparison app like jerry. Ad the right renters insurance policy offers peace of mind. Buying renters insurance starts with making an inventory of your stuff.

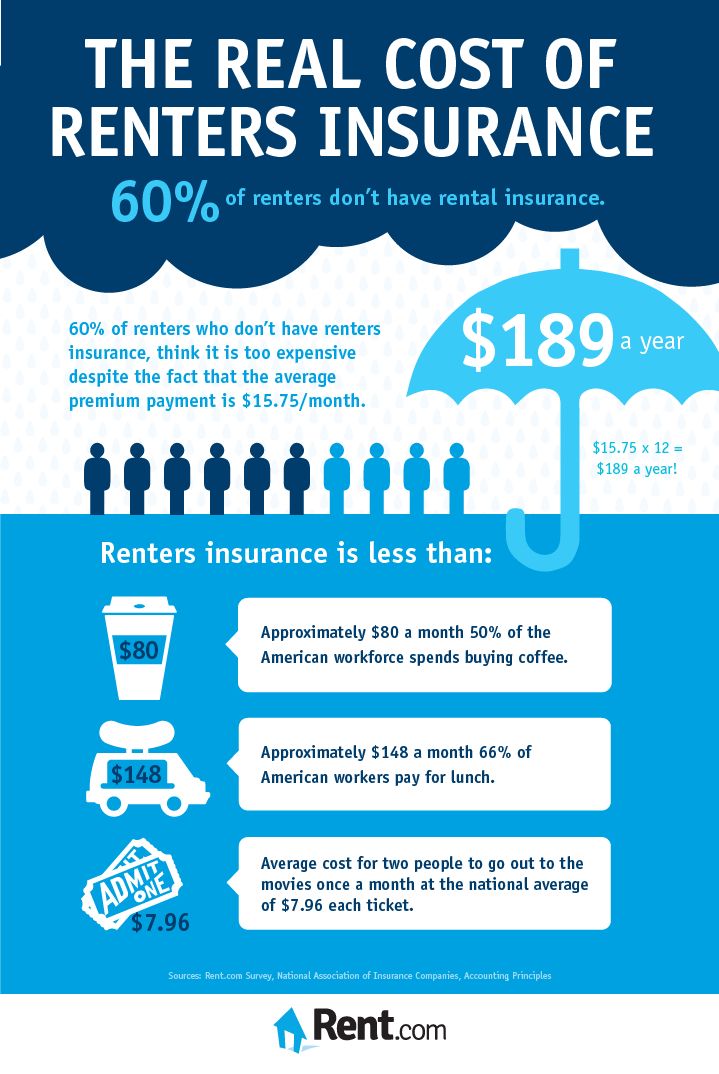

Ad protect your possessions with insurance as low as $5/month. Complete an inventory of your possessions. Among the popular renters insurance companies we analyzed, the average cost of renters insurance was only $165 a year for.

In california, the estimated price of renters insurance is $204 per year or around $17 per month. An allstate renters policy has an average monthly premium of about $16¹. Figure out how much you own.

Start a free online quote to see how much you can save today. Ad protect your personal possessions with an affordable renters policy. That is more than the $179 per year average for the country.

:max_bytes(150000):strip_icc()/whats-difference-between-renters-insurance-and-homeowners-insurance-v2-2694bc76e944405aa55fe2784c373999.png)

/Renters-insurance-4223009-final-a125edb41c2f4a4a980ef2cf069d7723.png)

/whats-difference-between-renters-insurance-and-homeowners-insurance-v2-2694bc76e944405aa55fe2784c373999.png)

/shutterstock_709343611.zimmytws.renters.insurance.cropped-5bfc335346e0fb0083c1e3dc.jpg)

:max_bytes(150000):strip_icc()/Renters-insurance-4223009-final-a125edb41c2f4a4a980ef2cf069d7723.png)