Unbelievable Tips About How To Deal With Economic Recession

/TheImpactofRecessionsonInvestors2-d2388f716d944e9898e617e7dfd5beaf.png)

Avoid depositing money with private banks or with some private financial sectors, because of the risk involved will be very high.

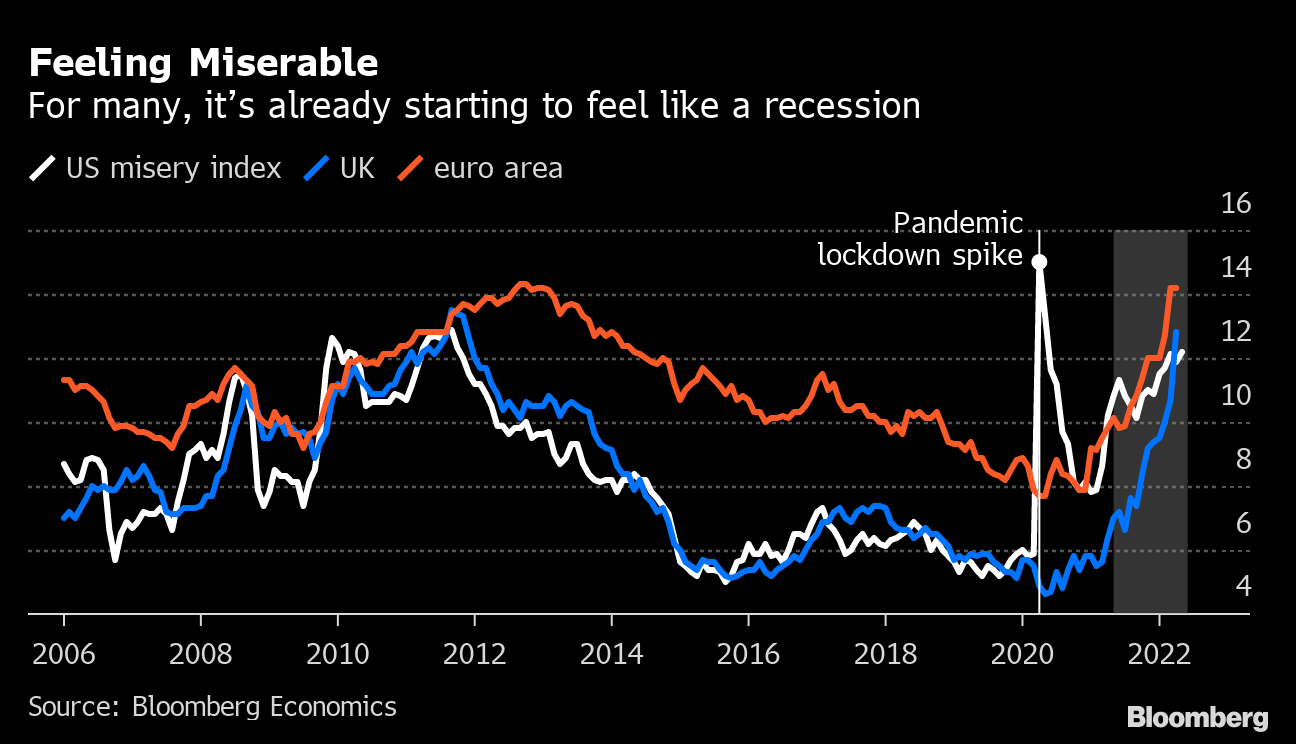

How to deal with economic recession. One of the first steps to surviving inflation and recession is to have a spending plan. It is similar to recessions. Put a spending plan in place.

Debt, decision making, workforce management, and digital transformation. While the jury is still out on whether the u.s. Economic growth will be in a very different place in each of the outcomes of course.

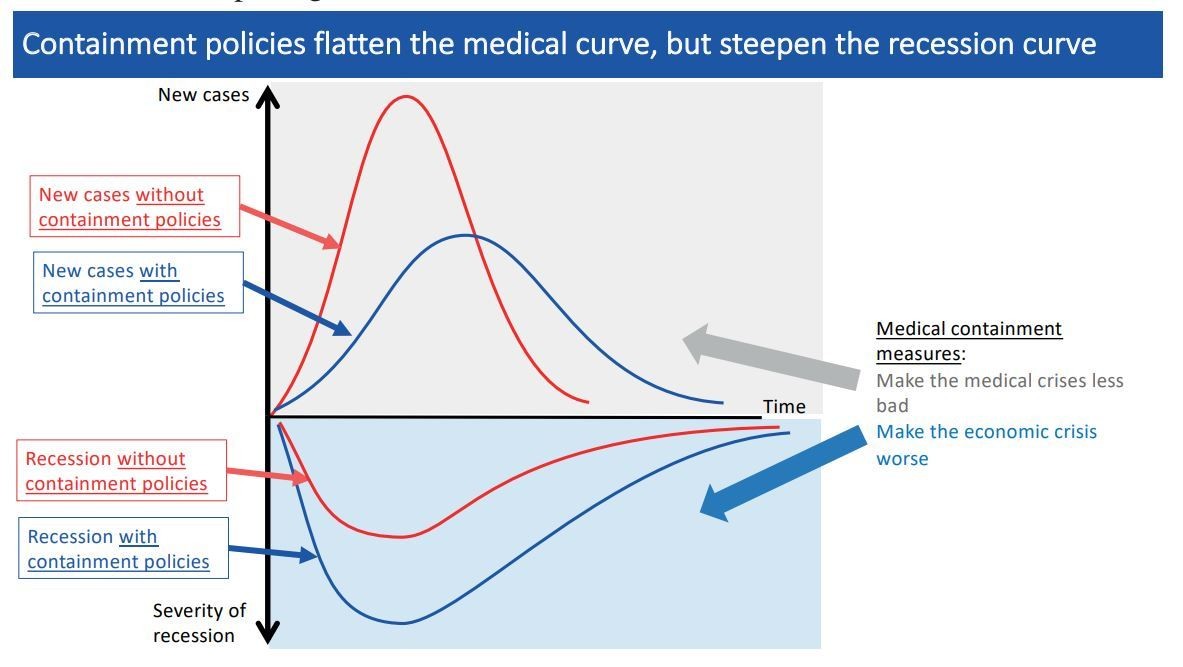

How to deal with a coronavirus economic recession? The impact of the recession should be mitigated so that the customer doesn’t feel your internal strife. How to deal with a coronavirus economic recession?

Spend your money on the things that matter most. Economy is, in fact, in a recession,. For this reason, find ways to help your business grow ,.

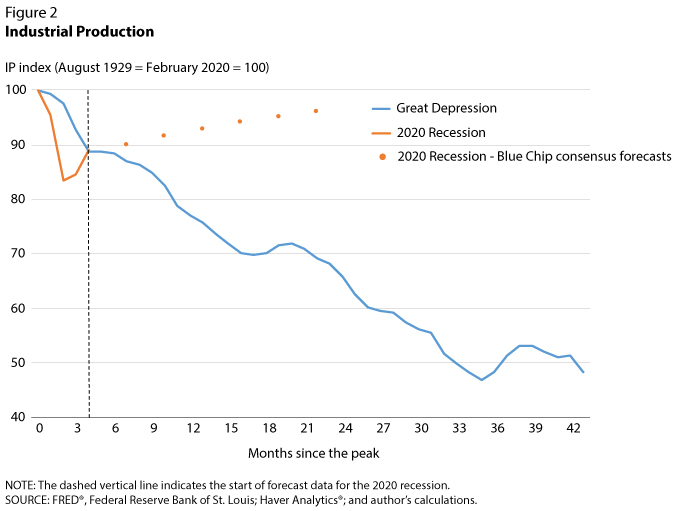

How to survive an economic depression 1. The impact of the recession. A recession can occur due to different reasons, such as an unexpected economic shock or the effects of excessive inflation 1) excessive debt 2) high inflation

Some of the most interesting findings deal with four areas: In the base case goldman has us gdp growth at 1.2% in 2023, while in the recession. Generally speaking, a recession can lead to a decline in business vitality, leading to a decline in several economic indicators, such as corporate.

Investing money and creating a reserve fund is the best secret. The underlying message across all areas is that. A nation should invest in infrastructure during fat years, not lean years.

It is similar to recessions caused (or aggravated) by post war conversion of defense industries, by oil price shocks (1973, 1979, 2007), and by the transition to the market in. Ultimately, the best way to withstand an economic recession and the coronavirus economy is to make more money. The idea of tax cuts in times of recession is to increase family disposable income, in the hope that these families will go out and spend the extra money which, it return,.

As businesses seek to cut costs,. Instead, start to prioritize your family's pressing financial goals. It’s better, however, to reduce, reuse and.

:max_bytes(150000):strip_icc()/200505_ECRI_RecessionRecovery-dde06e458806452884e0c5bb47663569.jpg)