Fun Info About How To Draw A Personal Budget

How to draw a personal budget that works.

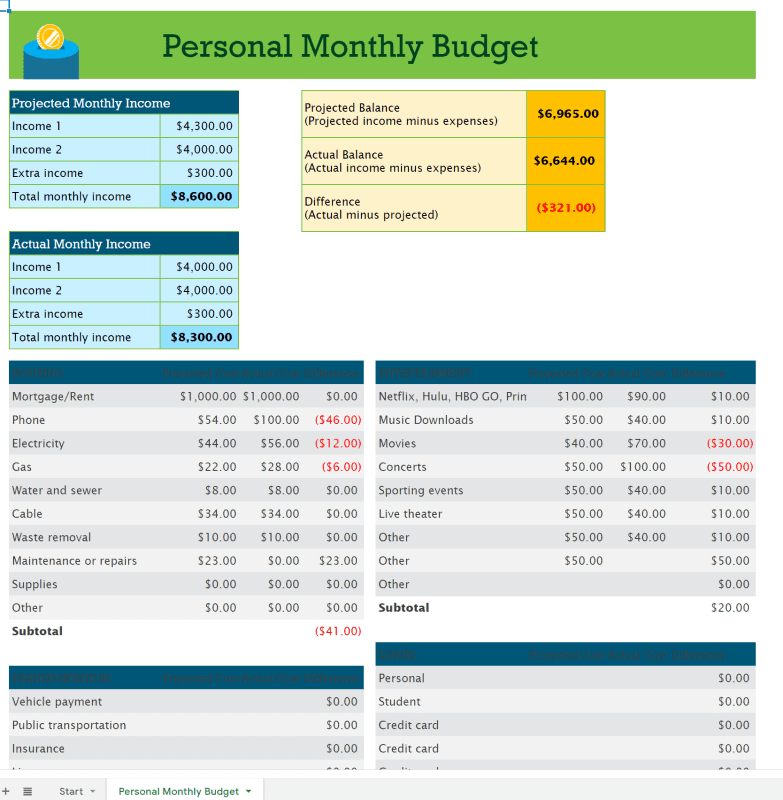

How to draw a personal budget. How to make a monthly budget. Set savings and debt repayment goals. Follow these steps to get started.

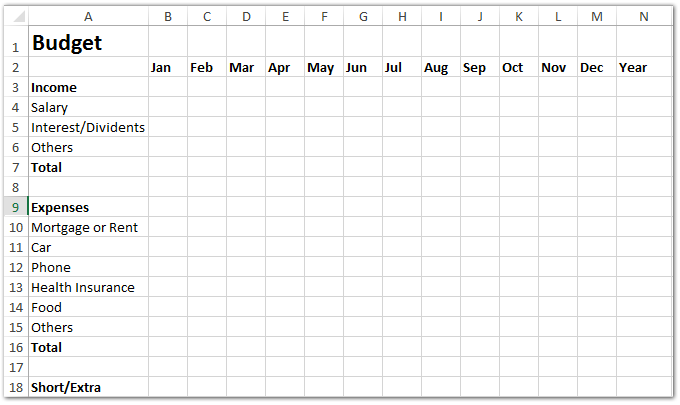

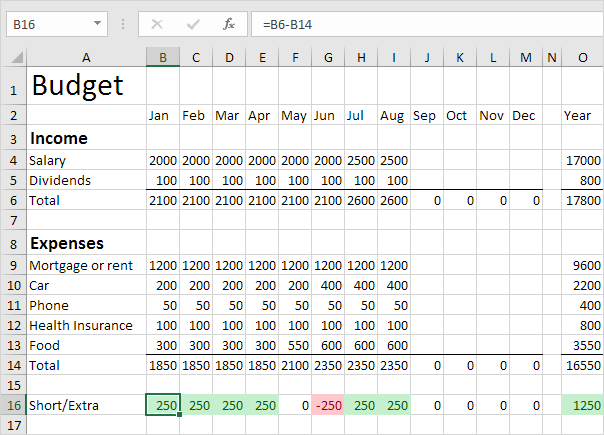

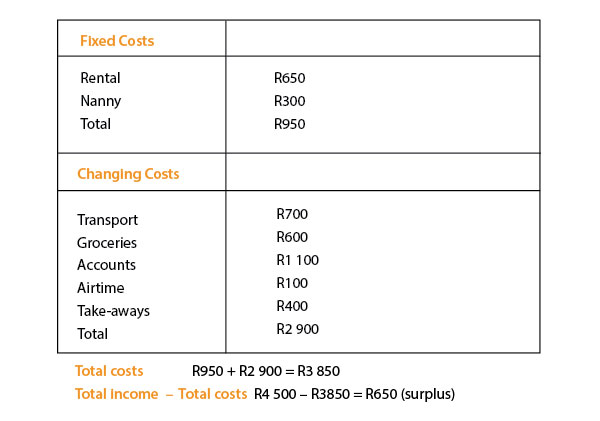

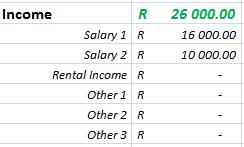

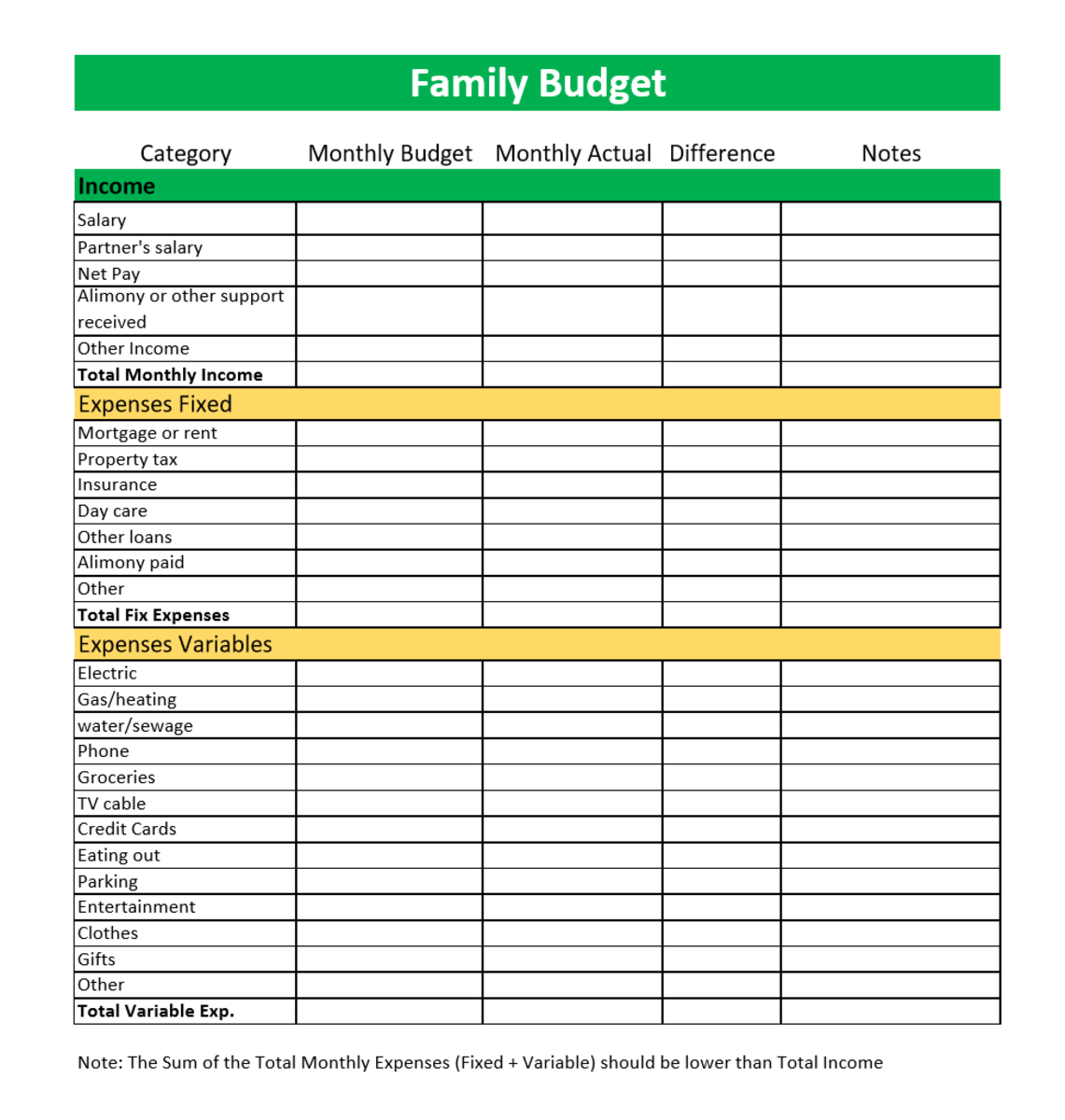

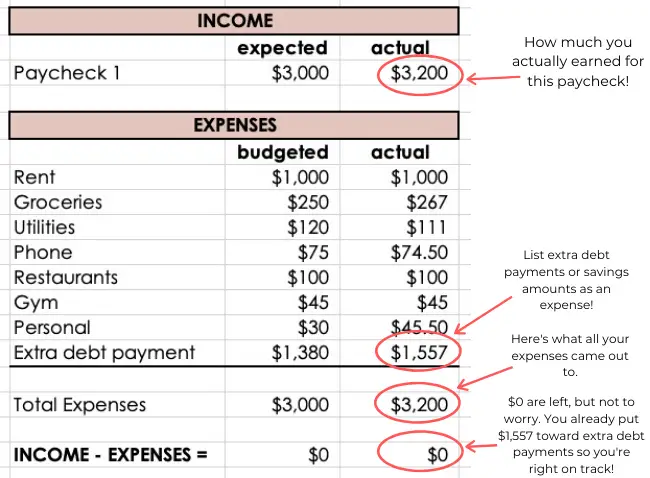

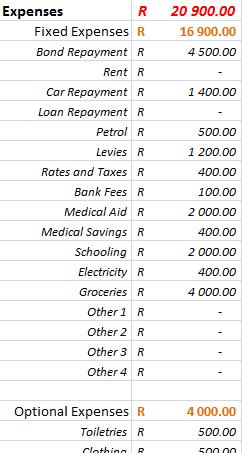

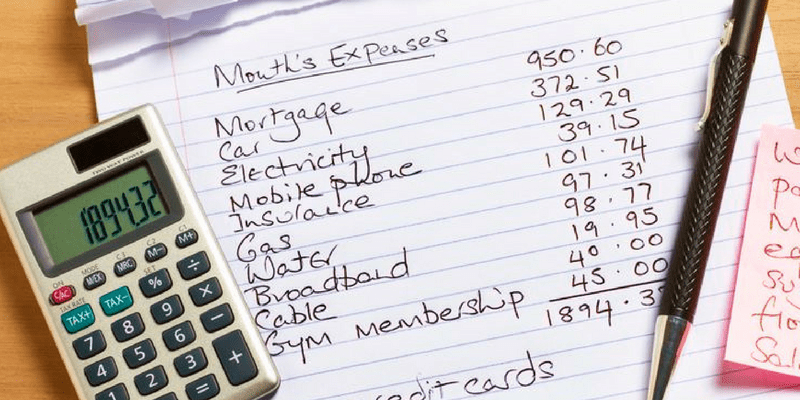

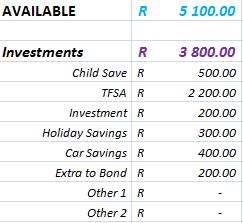

Planning your personal financial affairs through prioritization of needs and budgeting income and expenses. Add up the monthly income you expect from all sources categorize and add up the monthly expenses you expect to pay. Planning your personal financial affairs through prioritization of needs and budgeting income and expenses.

Ad your complete money management solution to reduce debt and maximize finances. Use how often you get paid as the timeframe for your budget. Find helpful tips along the way, like which debts to pay first and how much to pay.

Planning your personal financial affairs through prioritization of needs and budgeting income. Follow these simple steps to get the ball rolling: How to draw a personal budget that works.

Planning your personal financial affairs through prioritization of needs and budgeting income and expenses. They then borrow to make. Ad with a few steps, the tool could help you make a plan based on your budget.

Create a budget to pay off debt, save for a down payment, or plan for retirement One popular budgeting strategy is the 50/30/20 rule, which separates your spending by category: However, this is not a prudent way of managing your personal financial affairs.

The basic process for making a budget goes like this: Record your income record how. However, this is not a prudent way of managing your personal financial affairs.

How to draw a personal budget that works. Ad a more equitable community. They then borrow to make.

Ad a more equitable community. They then borrow to make. However, this is not a prudent way of managing your personal financial affairs.

For example, if you get paid weekly, set up a weekly budget.