Sensational Info About How To Get A Overdraft

This solution may not be immediately obvious or desirable.

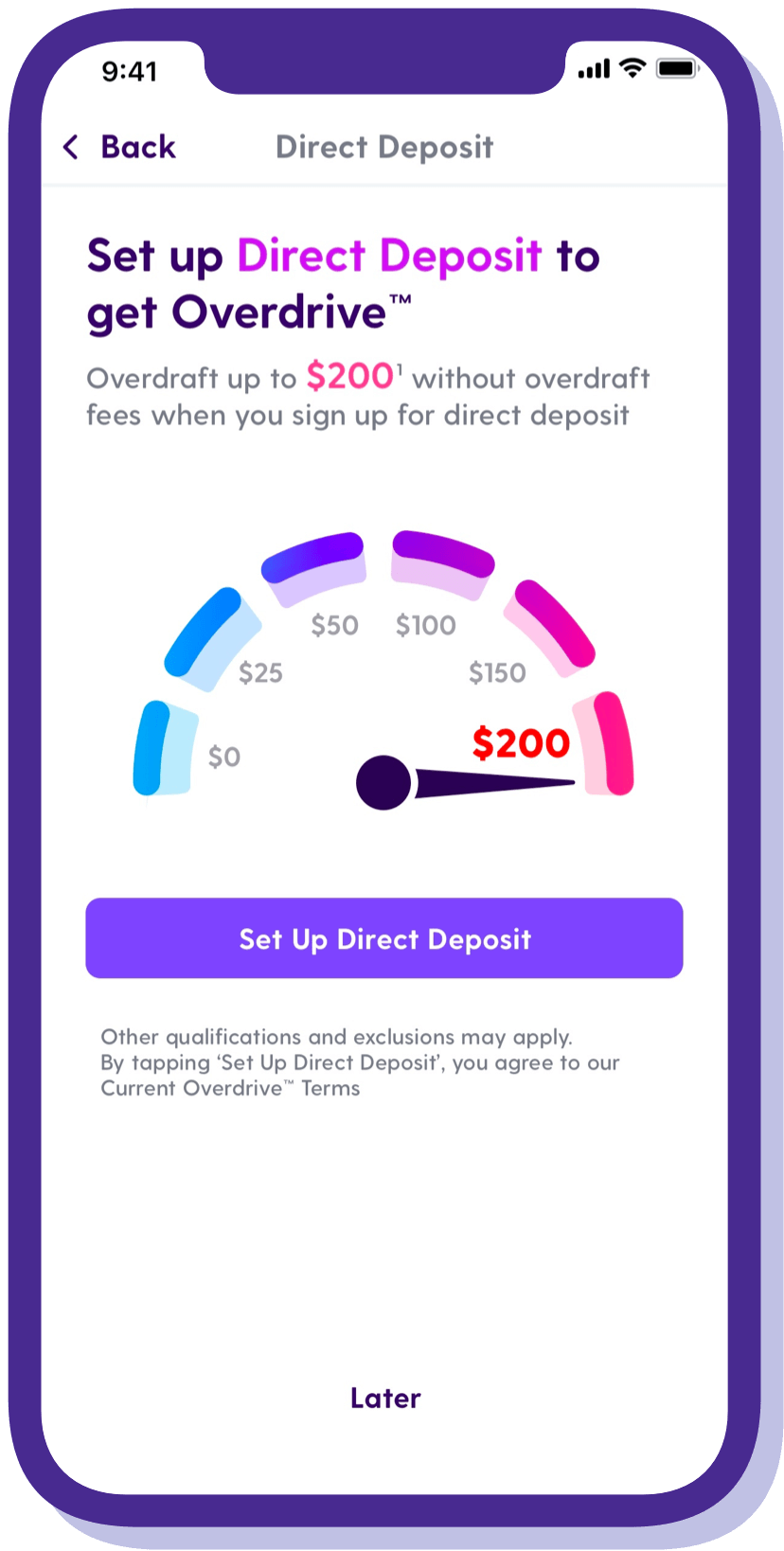

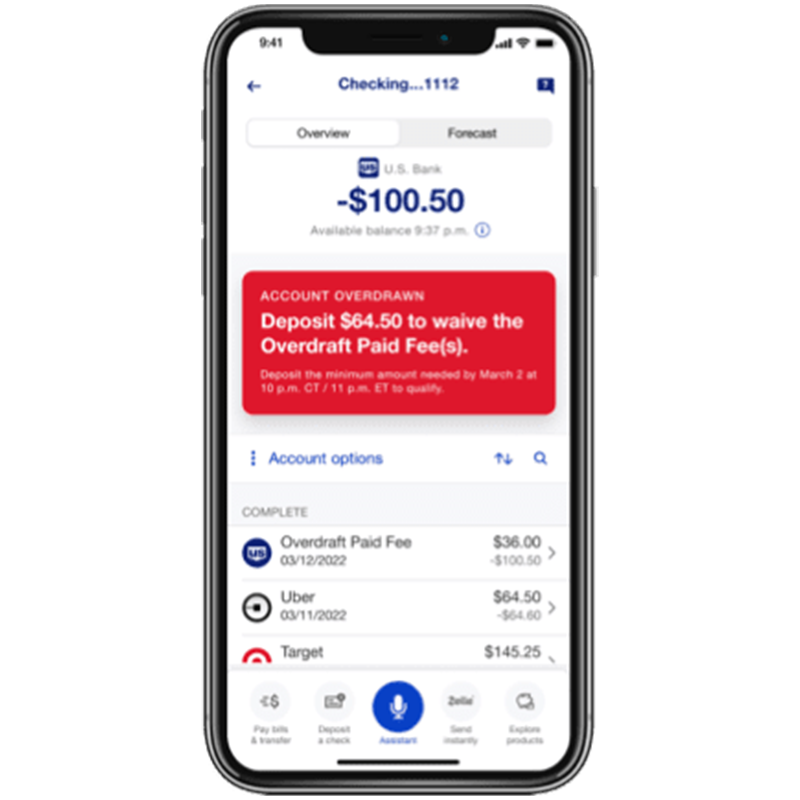

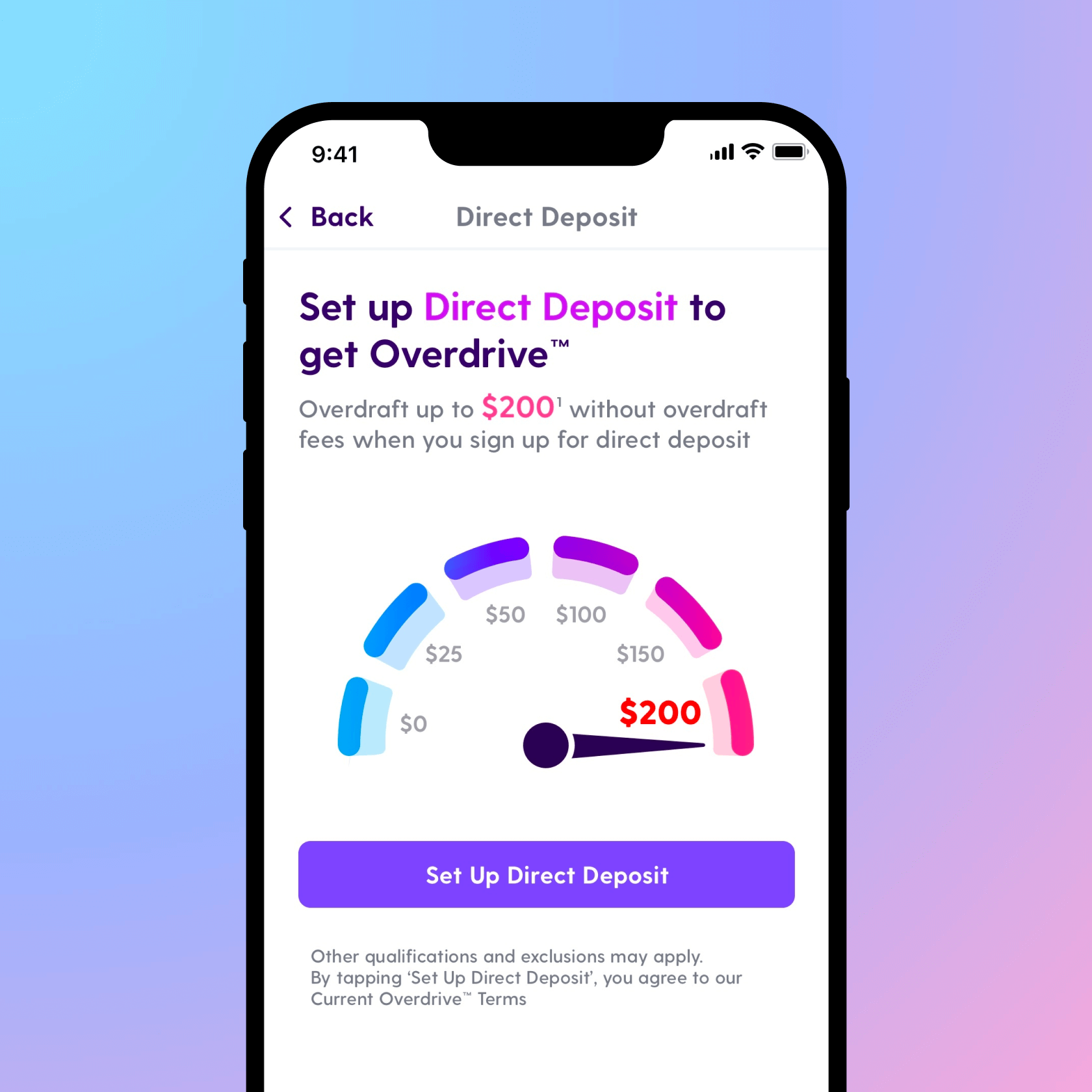

How to get a overdraft. When your bank account balance reaches a predetermined amount, you may set up an alert to notify you of the situation. If you’re overdrawn by $50.01 or more and you were charged an overdraft paid fee (s), overdraft fee forgiven 1 gives you time to take action 2 to have the fee (s) waived. On all pnc accounts, you'll get a refund if it has a negative balance of $5 or less.

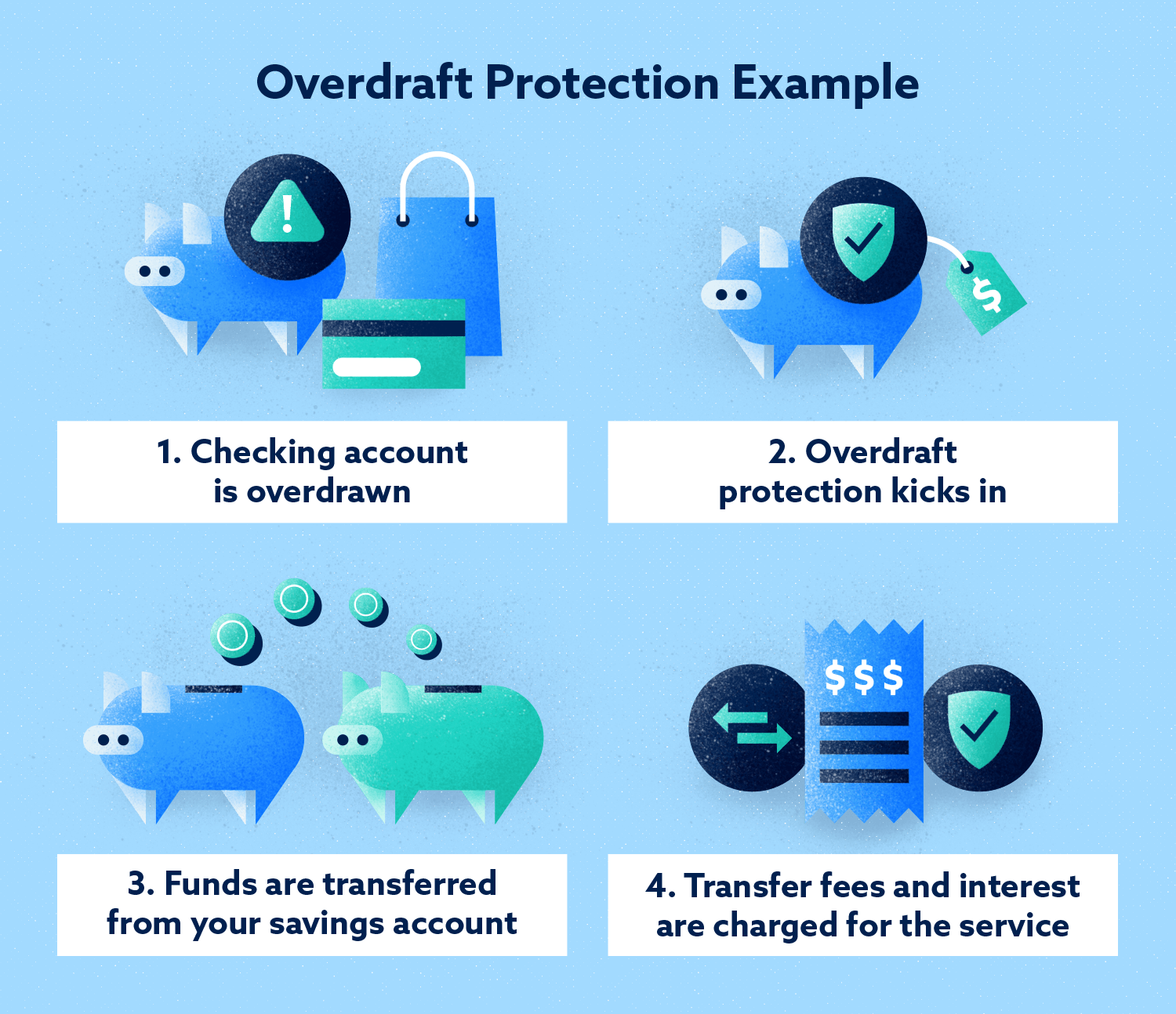

But, if you have savings, it’s nearly always advantageous to. An overdraft happens when you don't have enough money available to cover a purchase or a payment. If you don’t have enough money in your account to pay for a purchase, your bank may transfer funds from another checking or savings account to cover.

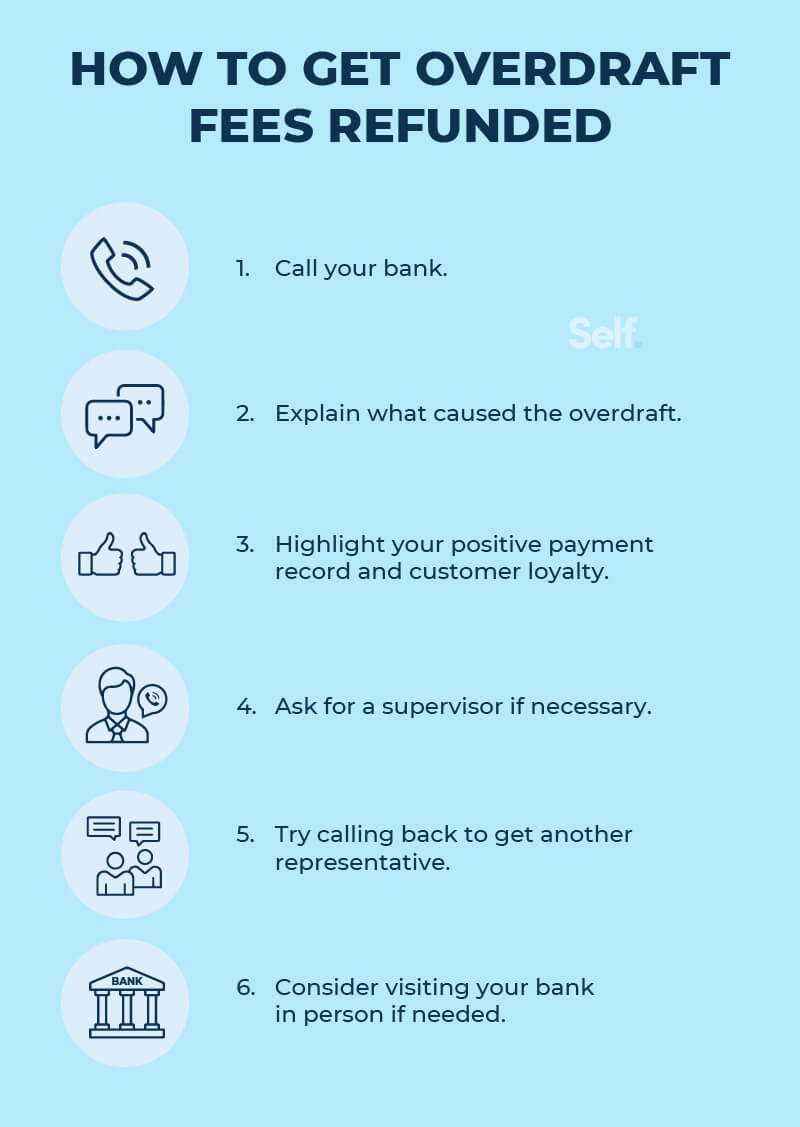

Overdraft protection advances from a credit account accrue interest from the date each advance is made. The td bank beyond checking account comes with overdraft payback. Here are 3 easy steps to help you get an overdraft fee refund:

A polite but firm approach can get you more than you might think. The process isn’t very complex and involves picking up the phone to give your bank a call. Pay back the overdrawn amount before the end of the day;

$0 overdraft fees if you’re overdrawn by more than $50 at the end of the business day and you bring your account balance to overdrawn by $50 or less at the end of the next business. Please note a few things: Another way of saying this is an overdraft happens when a.

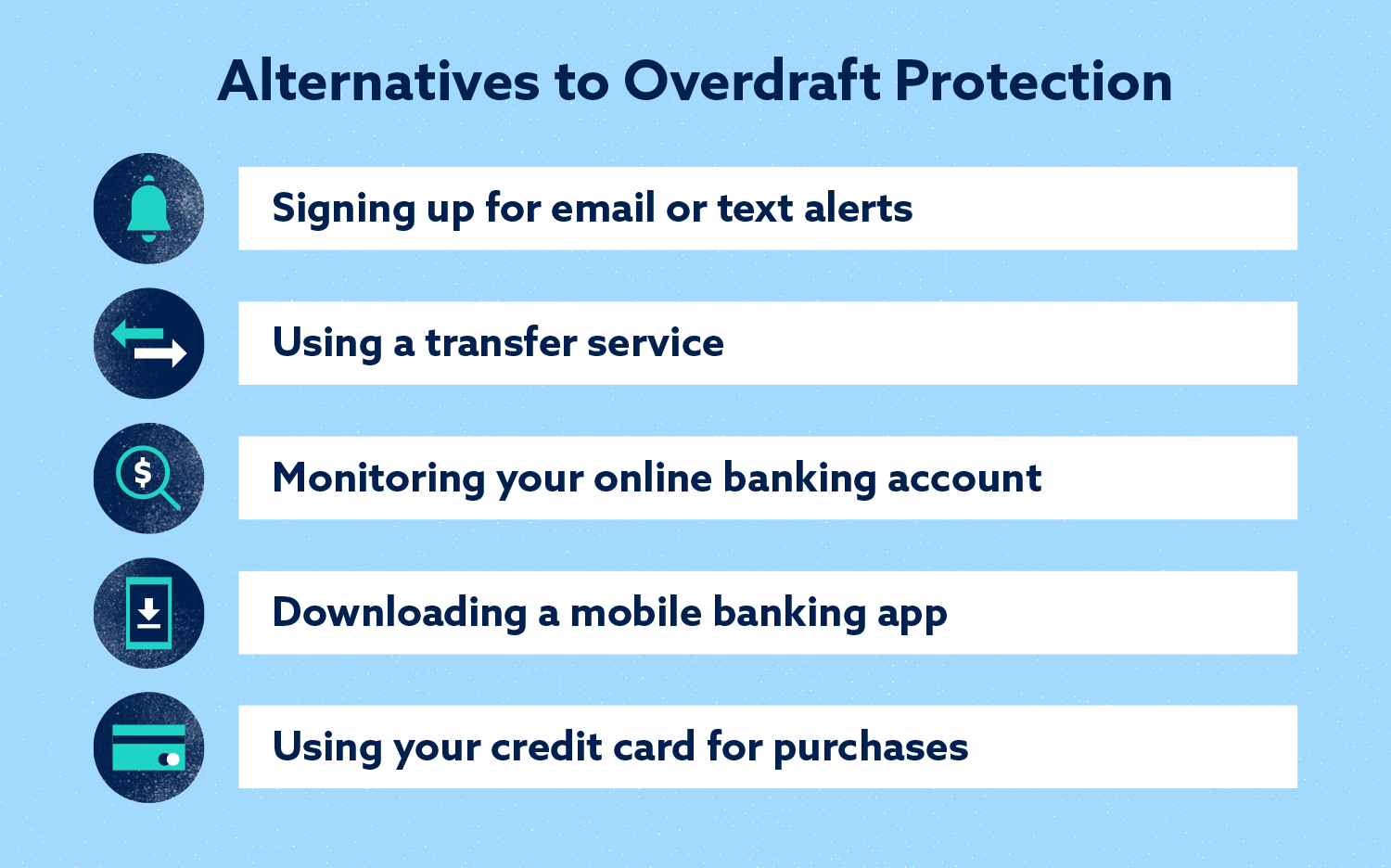

To enroll, change or remove overdraft. Switch to a credit card. Though credit cards come with their own challenges, they can also provide a solution to overdraft debt.

If you don’t have overdraft protection and can’t cover a. Using this checker doesn’t guarantee you’ll. To avail such an overdraft you need to have a salary account with the said bank.

Go into overdraft by a small amount, such as $5 or less; Steps for getting overdraft fees refunded 1. There are four basic steps to get your overdraft fees (and any other bank fee).

Check if you're eligible for an overdraft. Especially now that overdraft interest rates are. Don’t be defeated just yet if that’s the case:

You can use this eligibility checker to see if you’re likely to get an overdraft with us.

/images/2021/09/09/smiling-woman-using-debit-card.jpeg)

.png)

:max_bytes(150000):strip_icc()/dotdash-what-difference-between-overdraft-and-cash-credit-Final-8e1e4594a99342748fc565d7c5dd66d3.jpg)