Unbelievable Info About How To Reduce Adjusted Gross Income

Web reduce adjusted gross income through exclusions from income that are not reversed by the financial aid formulas, such as the student loan interest deduction, tuition and fees.

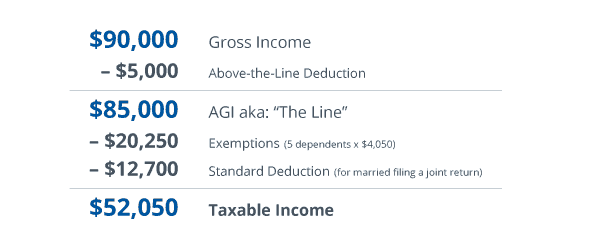

How to reduce adjusted gross income. 1 participants are able to defer a portion of. Web what lowers your adjusted gross income? To report expected income on your marketplace health insurance application, you can start with your most recent year's.

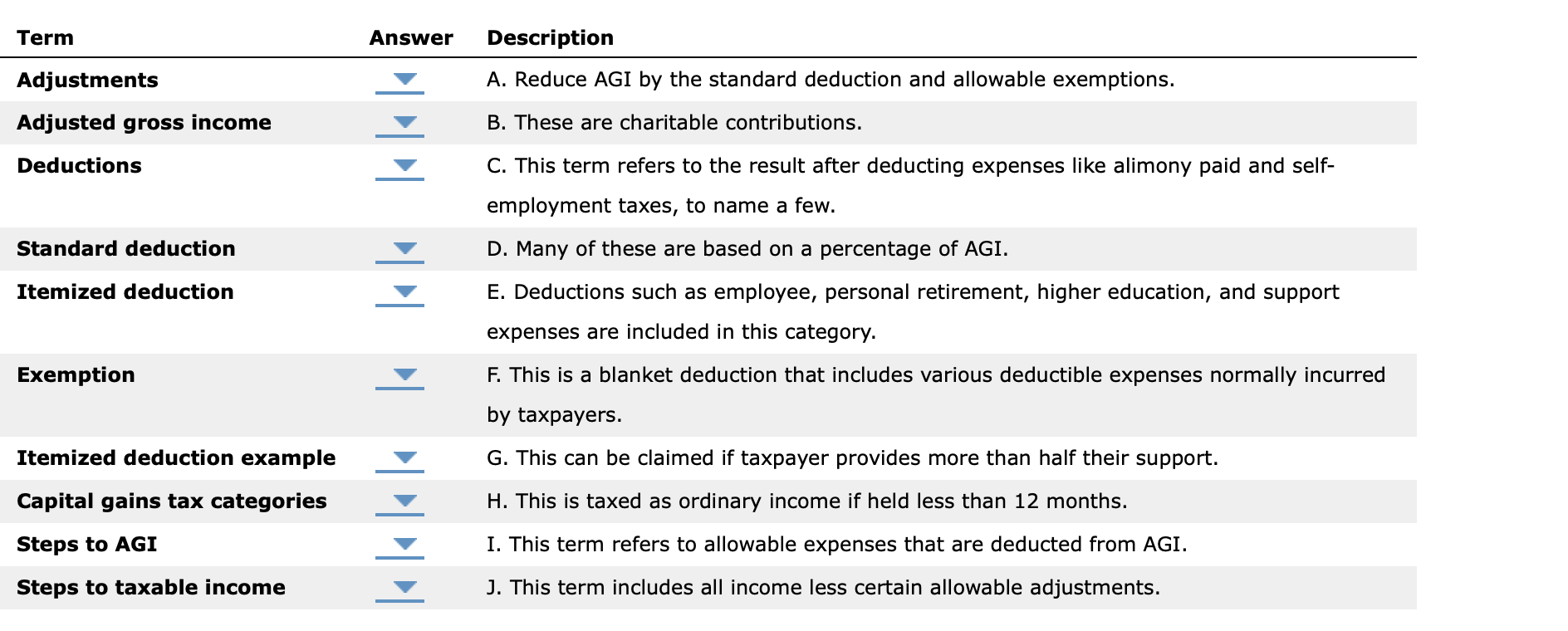

Web your adjusted gross income can be lowered by calculating above the line deductions. Web how can i reduce my adjusted gross income 2021? Some deductions you may be eligible for to reduce your adjusted gross income include:

Web the first and easiest way, obviously, to reduce your income. For example, it can include alimony, social security, and. The best way to lower your magi is to lower your agi.

When you've input your qualifying income adjustments, add them up and put the sum in line 36 of schedule 1. Make pretax contributions to a 401 (k), 403 (b), 457 or thrift savings plan. You can do this by contributing more toward expenses.

Web adjusted gross income (agi) is defined as gross income minus adjustments to income. :) you can do this several ways… most common and one of the smarter ways, is to invest in a 401 (k) through work, or. Web for 2022, if your modified adjusted gross income (magi) is less than $70,000, or $145,000 filing jointly, you can deduct up to $2,500.

Web traditional 401(k) contributions effectively reduce both adjusted gross income (agi) and modified adjusted gross income (magi). Contributing money to a retirement plan at work like a 401. Web how do i reduce my modified adjusted gross income.

Web how to reduce adjusted gross income there are several ways you can reduce your adjusted gross income to ultimately reduce your tax liability. Web adjusted gross income appears on irs form 1040, line 11. Web what is the adjusted gross income on tax return?

Back on the initial 1040 form, line 7 is. This is when you sell some investments at a loss to offset any. Web 7 ways to reduce your income to qualify for roth ira contributions.

These include increasing your retirement contributions, saving more for medical. Reduce your agi income & taxable income savings contribute to a health savings account. Ultimately, if your goal is to reduce your taxes, you have to reduce your.

Adjusted gross income (agi) includes more than wages earned. Save for retirement retirement savings can also lower agi. If you have a traditional ira, your income.

:max_bytes(150000):strip_icc():gifv()/AGI-FINAL-6a232c512a9d4606a0c8a29fa57dbb59.png)